Can Fannie Mae Stock Hit $20 in 2025?

Fannie Mae (FNMA) is back in the spotlight after receiving its first bull rating on Wall Street. The call comes at a pivotal moment, as U.S. President Donald Trump’s administration is reportedly weighing plans to sell part of the government stake in both Fannie Mae and Freddie Mac (FMCC)—an offering that could begin as early as this year.

For years, investors have debated the fate of these government-sponsored enterprises, which have operated under federal conservatorship since the 2008 financial crisis. While both companies have since returned to profitability and paid billions in dividends to the U.S. government, questions around their long-term independence have lingered. And those questions may finally be moving closer to resolution.

That leaves investors facing a critical question: with Fannie Mae stock rallying on fresh optimism, can shares realistically reach $20 in 2025—or is the market running ahead of itself?

About FNMA Stock

The Federal National Mortgage Association, better known as Fannie Mae, is a government-sponsored enterprise created in 1938 to provide liquidity and stability in the U.S. housing market. Together with Freddie Mac, the company plays a vital role in the U.S. mortgage industry by purchasing mortgages from lenders and bundling them into mortgage-backed securities (MBS). Fannie Mae and Freddie Mac guarantee the MBS, giving investors confidence that they will be paid even if homeowners default on their mortgages.

Fannie Mae has been under federal conservatorship since 2008. Both Fannie Mae and Freddie Mac needed a government bailout in 2008 after the housing bubble burst, as they were exposed to risky loans and securities that included subprime mortgages. The companies suffered billions in losses before Congress created the Federal Housing Finance Agency and placed them into conservatorship. Notably, Fannie Mae and Freddie Mac have paid billions in dividends to the U.S. government under conservatorship, exceeding the amounts they received in the bailout, and are now profitable.

Shares of the secondary mortgage market giant have more than tripled this year amid growing optimism that the Trump administration would address long-standing questions surrounding the company’s government conservatorship.

Fannie Mae Receives First Bull Rating on Wall Street

Last Thursday, Fannie Mae and Freddie Mac received their first “Buy” recommendation from Wall Street. More specifically, Deutsche Bank initiated coverage of the stocks with a “Buy” rating, setting a price target of $20 for Fannie Mae and $25 for Freddie Mac. The bank’s analyst, Mark DeVries, said the stocks’ sharp rally could continue on expectations that the mortgage giants may soon be released from government control.

“Despite already rallying ~300% year to date, we still see attractive upside for both stocks as the companies near a likely recap & release, though with meaningful downside if the recapitalization process brings greater-than expected-dilution,” Deutsche Bank analyst Mark DeVries wrote in a note.

In recent weeks, the shares have gained partly due to comments from government officials suggesting that President Donald Trump’s administration is considering selling stakes in both companies through an offering that could begin as early as this year. Federal Housing Finance Agency Director Bill Pulte said earlier this month that the administration is considering offering roughly 5% of each entity. Also, Commerce Secretary Howard Lutnick said in an interview last week that the administration could sell “a small percentage of these companies” as early as this year.

Deutsche Bank’s DeVries said that the companies will likely be recapitalized and released from government conservatorship. However, “the value of the outstanding common is less clear because it will hinge on several key issues that have yet to be clearly resolved,” he noted. One key issue is the Treasury’s stake through its senior preferred shares, which, if converted into common stock, would dilute existing common shares. Other unresolved issues include whether the government will adjust the capital requirements for the companies and how it will guarantee future government support for their mortgages.

“If the government ultimately acknowledges that it has been repaid, which we believe it has, then the common has significant upside potential from here,” DeVries said. “If the government refuses to recognize that it has been repaid, however, then any path forward likely involves significant dilution to the existing common that leaves it with limited value.” That said, the analyst warned of a “meaningful downside if the recapitalization process brings greater-than-expected dilution,” adding that “buying the outstanding common shares is not for the risk-averse.”

How Did Fannie Mae Perform in Q2?

On July 30, Fannie Mae reported its financial results for the second quarter of 2025. The company’s net revenues remained largely unchanged year-over-year (YoY) at $7.2 billion, supported by stable guaranty fee income on the company’s $4.1 trillion guaranty book of business. Its second-quarter net income came in at $3.3 billion, marking the 30th straight quarter of positive net income. However, the figure dropped 9% sequentially and 26% from a year earlier, which CEO Priscilla Almodovar attributed to a higher provision for credit losses.

Fannie Mae maintained strong credit quality and capital growth, delivering a 9.5% return on equity. The company achieved a net worth of $101.6 billion in Q2, up 3% quarter-over-quarter (QoQ) and 18% YoY. Notably, the company has grown its net worth by $88.1 billion since the start of 2020.

Meanwhile, Fannie Mae’s continued focus on operational efficiency paid off in Q2, helping reduce administrative expenses by 15% since the first quarter, which resulted in total savings of $256 million in non-interest expenses. CEO Almodovar noted that the significant progress on expenses was largely supported by the efficiency and deregulation initiatives led by U.S. Federal Housing Director William Pulte and the entire FHFA team.

Fannie Mae provided $102 billion in liquidity during Q2, supporting the financing of roughly 381,000 home purchases, refinancings, and rental units. It is worth noting that 52% of the home purchase mortgages acquired went to first-time buyers.

According to Wall Street projections, FNMA is expected to post a moderate 5.25% YoY revenue growth to $30.26 billion in fiscal 2025.

What Do Analysts Expect For FNMA Stock?

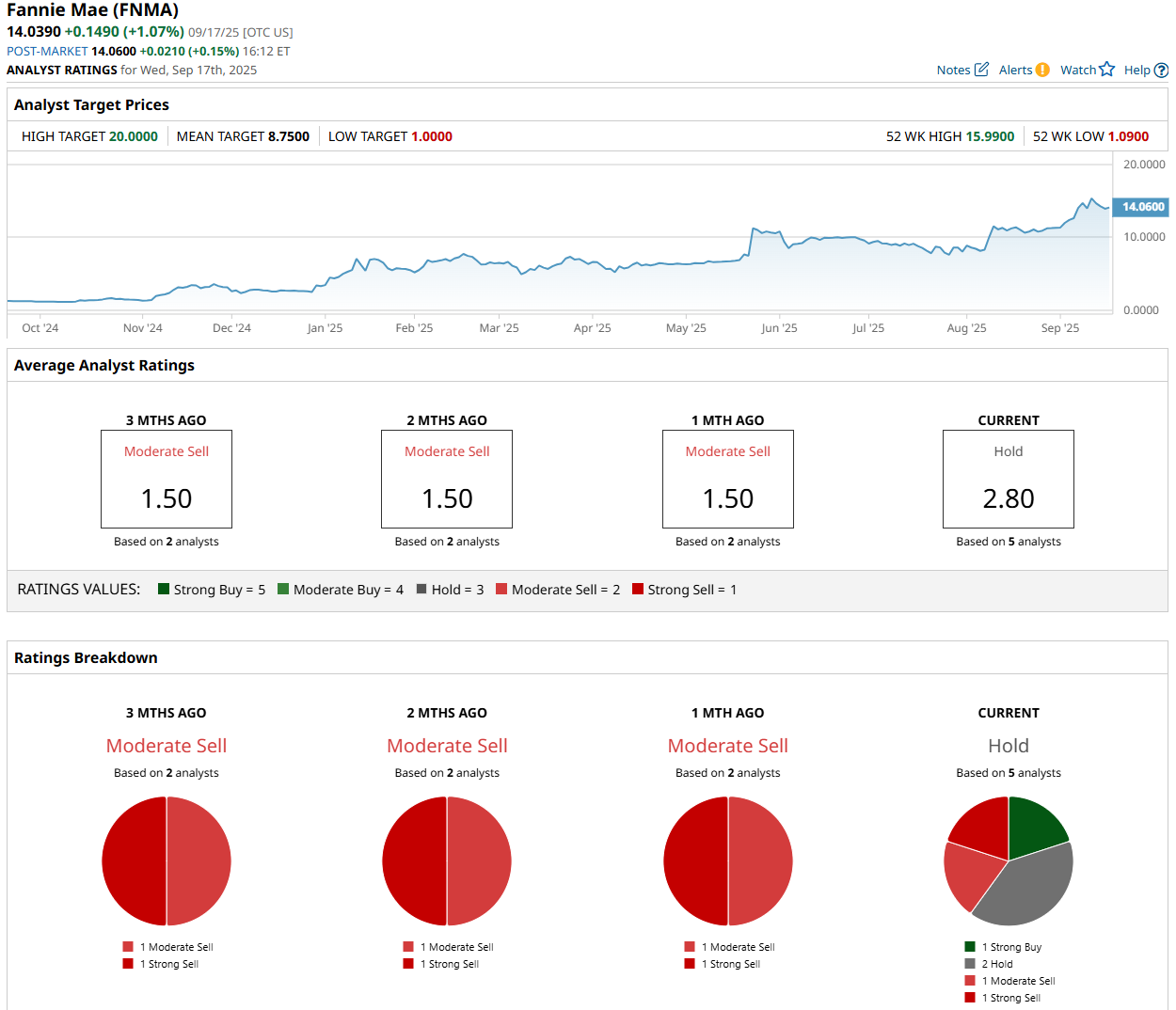

Wall Street analysts have a consensus rating of “Hold” on FNMA stock. Of the five analysts covering the stock, one rates it a “Strong Buy,” two suggest holding, one gives it a “Moderate Sell” rating, and one assigns a “Strong Sell” rating. Unsurprisingly, after its strong run this year, the stock is trading above the mean price target of $8.75. However, the Street-high target price of $20, set by Deutsche Bank, indicates a potential upside of 42.6% from current levels.

If outstanding questions surrounding its conservatorship are resolved, FNMA could certainly hit these price targets. Any further progress toward freeing the mortgage giant from government control is likely to drive its stock higher. However, buying the stock at current levels carries risks, and as Deutsche Bank’s Mark DeVries noted, “[it] is not for the risk-averse.” DeVries’ price targets are based on four scenarios, weighted by their likelihood “given the significant impacts to the common from these unresolved questions.” In the analyst’s worst-case scenario, where the senior preferred stock is converted into common shares, he projects that Fannie Mae and Freddie Mac stock would be worth $1.50, implying significant downside.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.